IRS Form 1098, also known as the Mortgage Interest Statement, is a crucial document for homeowners in the United States come tax season. This statement reports the amount of interest and related expenses paid on a mortgage within the tax year to both the borrower and the Internal Revenue Service (IRS). Generally, the IRS 1098 mortgage form is essential for taxpayers who are itemizing their deductions. It allows them to claim the interest paid on a mortgage, potentially reducing their taxable income and ensuring accurate compliance with tax regulations.

Navigating the complexities of tax documents can be daunting, yet the availability of IRS Form 1098 with instructions in PDF at our website, 1098-irsform.com, simplifies the process. By providing comprehensive instructions and concrete examples, our valuable resources aid in completing the 2023 IRS Form 1098 with ease. With easy-to-follow guidance, taxpayers can confidently fulfill their reporting obligations, understand their deductible mortgage interest, and avoid common filing errors, ensuring their tax filings are both compliant and optimized for their financial benefit.

The IRS 1098 Form Requirements for the 2023 Tax Year

Understanding the requirements for the 1098 IRS form for 2023 is essential for homeowners and lenders alike. This document serves as a report of mortgage interest payments that have been made over the last tax year. Entities issuing a mortgage, such as banks or financial institutions, are generally responsible for completing this form. When a borrower pays $600 or more in mortgage interest throughout the tax year, the lender must provide both the homeowner and the IRS with a copy of the 1098 form.

However, not all mortgage-related activity warrants the submission of this form. Below is a list that details scenarios where individuals or entities are exempt from filling out and filing the IRS tax form 1098 for mortgage interest:

- Payment records for loans not secured by real estate

- Mortgage interest payments that fall below the $600 threshold

- Interest paid on personal property loans

- Interest collected on behalf of non-mortgage loans

Please note that those who meet the criteria for filing are encouraged to utilize the available blank template fully, which can be downloaded or completed online. Compliance maintains the transparency and accuracy of financial reporting.

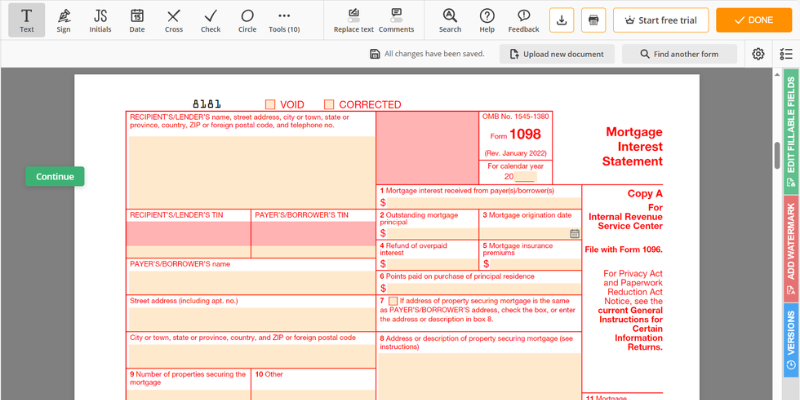

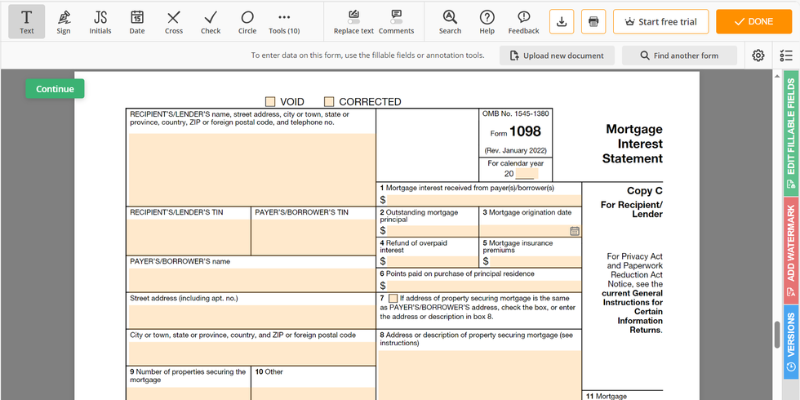

Instructions to Fill Out Blank Form 1098 Correctly

Welcome to your simplified guide designed to assist you in completing the IRS Form 1098 with precision. Follow these clear step-by-step instructions to ensure an error-free submission:

- Begin by accessing our website and opening the IRS Form 1098 template in a PDF editor. Ensure you have the latest version for the relevant tax year.

- Review the 1098 form instructions provided to familiarize yourself with the required information and the form's layout.

- Collect necessary documentation, such as mortgage interest statements or relevant transaction records, before you start filling out the template.

- Complete the offered sections with accurate details, including the payers' and recipients' tax identification numbers and addresses.

- Enter the mortgage interest received from the payer, remembering to report the exact amount in the appropriate boxes.

- The final steps include verifying all entered information for accuracy, signing where required, and using our platform to file IRS Form 1098 online if you choose the digital filing method.

Utilize our resources to navigate this process, ensuring compliance and timely completion confidently.

Deadline to File the 1098 Mortgage Interest Statement

The due date for filing printable IRS Form 1098 is typically set for January 31st of the year following the one in which the mortgage interest payments were made. This specific timing aligns with the end of the fiscal year, ensuring that taxpayers receive their relevant deduction information in time for the federal tax filing season. This synchronization helps both taxpayers and the IRS to maintain a well-organized and timely tax processing system.

While the January 31st deadline is firm, the IRS does provide options for those who require additional time. Should you find yourself in need of an extension, it is imperative to act proactively. One can file the 1098 online, utilizing the IRS electronic filing system, which may streamline the process and help to manage the timeline effectively.

IRS Form 1098 for 2023 - Instructions

IRS Form 1098 for 2023 - Instructions

Fillable 1098 Form

Fillable 1098 Form

1098 Mortgage Interest Instructions

1098 Mortgage Interest Instructions

Printable 1098 Form

Printable 1098 Form

File Form 1098 Online

File Form 1098 Online