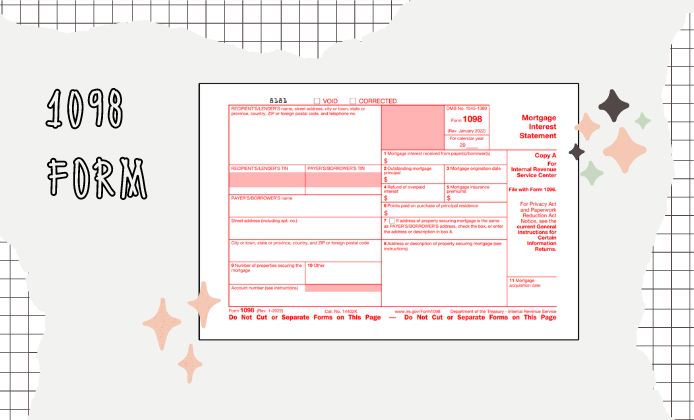

Filing your taxes can be complex, but understanding each form can make it much more manageable. For homeowners with a mortgage, one of the vital documents during tax season is the printable 1098 mortgage interest form. This crucial tax document, typically provided by your mortgage lender, helps you report the interest and related expenses paid on a mortgage during the tax year. It aims to facilitate accurate mortgage interest deduction when preparing your annual tax returns.

The Structure of the 1098 Form for Print

The template is divided into multiple boxes, each designed to capture specific details of your mortgage.

- The most important sections include the amount of interest received by the lender (Box 1).

- Any points paid on the purchase of a principal residence (Box 2).

- The mortgage insurance premiums (Box 3).

- Personal information, including the lender's and borrower's names and addresses, and the account number are also present to ensure proper identification and association with your tax records.

Steps to Fill Out a Printable 1098 Form

To ensure accuracy and compliance with tax regulations, follow these guidelines when completing your 1098 tax form printable:

- Double-check the lender's information

Confirm that the lender’s name, address, and tax identification number are correct. - Review your details

Ensure your name, address, and Social Security number are accurately reflected on the document. - Verify the mortgage interest amount

Match the mortgage interest amount reported on Box 1 with your statements for accuracy. - Confirm additional expenses

If you paid points on your mortgage or insurance premiums, confirm that these amounts are accurately recorded in Boxes 2 and 3. - Correct any discrepancies

If you notice any errors, contact your lender promptly to receive a corrected form.

Guide to Submitting Tax Form 1098

Once you've ensured that the tax form 1098 printable is accurately completed, the next step is to submit it properly:

- Attach Form 1098 to your tax return

If you're filing by paper, include the form with your tax return documents. - Electronic filing

When e-filing your tax return, enter the information from Form 1098 as prompted by the tax software. Retain the physical copy for your records. - Keep a copy

Always keep a copy of the form for your records. It may be needed for future reference or in case of an audit.

Deadline for the 1098 Form for 2023

The submission of printable Form 1098 is time-sensitive. For the tax year 2023, the statement must be sent to the taxpayer by January 31, 2024. To avoid any potential late-filing penalties or complications with your tax return, it is advisable to mark this date on your calendar and ensure you have received your form by then. If you have not received your Form 1098 by the due date, contact your lender to request a copy or confirm when it was mailed.

Timely submission of your printable 1098 form for 2023 can lead to a smoother tax filing experience and potentially benefit your financial situation with applicable deductions. Always consult with a tax professional for personalized advice and to maximize your tax benefits.

Printable 1098 Form

Printable 1098 Form

File Form 1098 Online

File Form 1098 Online