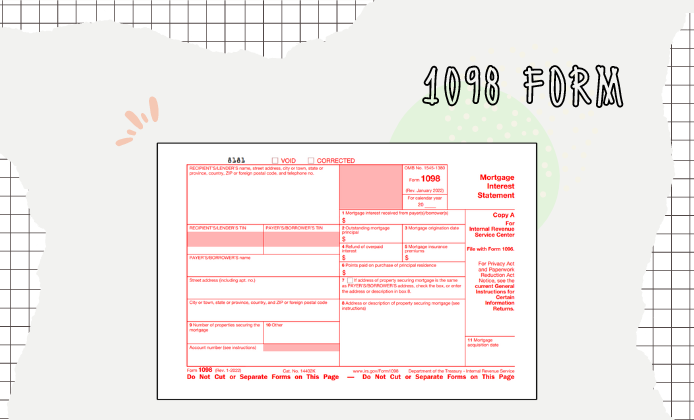

If homeownership is part of your American Dream, understanding the 1098 form is crucial come tax season. Commonly known as the Mortgage Interest Statement, Form 1098 serves as a report detailing the interest you paid on your mortgage throughout the tax year. It's not uncommon for mortgage lenders to mail this form to both you and the IRS, provided the interest you paid exceeds $600. The document outlines the amount of interest and related expenses you can claim as a deduction, potentially reducing your taxable income. Navigating the intricacies of how to get the 1098 mortgage interest statement online can be key to optimizing your tax return.

Advantages of the Fillable Form 1098

Modern technology allows you to deal with the 1098 form online, streamlining the process significantly. The online version is interactive, guiding users through various fields and ensuring all necessary information is captured accurately. One significant benefit of using the fillable version is the reduction of errors. With built-in checks and automatic calculations, the potential for incorrect entries is minimized. Also, accessibility is greatly improved; you can retrieve and complete the form from any location anytime. Another advantage is the speed of delivery and acknowledgment, as electronic submission leads to faster processing times.

Challenges in the 1098 Electronic Filing

Despite the advantages, there are hurdles to consider when you get the 1098 online.

- First-time users might find the process daunting due to unfamiliarity with the digital platform.

- Internet connectivity issues can also pose a challenge, potentially disrupting the submission process.

- Additionally, navigating the e-filing system may be confusing for some, underscoring the importance of carefully following outlined procedures and seeking help when needed.

Steps to Ensure Successful E-filing

Achieving a successful electronic submission begins with gathering all pertinent documentation, such as your mortgage account statement and personal identification details. Cross-referencing the digital 1098 form to file online with your records is essential to ensure accuracy. Be observant of the data entry fields and utilize the help functions available on the platform. Before submitting, double-check your entries for any inaccuracies. Finally, always keep a copy of the submitted form for your records as proof of filing.

Securing Your Data on Form 1098

When you file Form 1098 online, securing your sensitive personal data is paramount.

- Employ robust passwords and opt for multi-factor authentication, when available, to safeguard your account.

- Use a secure and private internet connection - avoid public Wi-Fi to reduce the risk of interception of your private information.

- Ensure that your computer is protected against malware with updated antivirus software.

- Finally, after getting the 1098 Mortgage Interest Statement online, ensure the website URL starts with 'https://' as the 's' signifies a secure connection, encrypting data between your browser and the website.

Filing electronically can be a boon for efficiency and accuracy. With a solid understanding of the 1098 form, its online capabilities, and the right security measures, you can navigate the e-filing landscape confidently and safeguard your fiscal standing.

Printable 1098 Form

Printable 1098 Form

File Form 1098 Online

File Form 1098 Online